Introducing “Money May” – a title that might not be groundbreaking, but hey, let’s roll with it. For the next 31 days, I’m embarking on a challenge: no spending on extras, all while striving to craft a vibrant and fulfilling life!

Let’s clarify: when I say “no spend,” I mean on the non-essentials. We’re still covering the basics like groceries and bills because, let’s face it, survival is key.

So, why am I subjecting myself to this financial detox? Firstly, the cost of living is spiraling out of control. Over the past 18 months, our monthly expenses have ballooned by a staggering $2,500 per month. Couple that with the fact that I’ve just resurrected my marketing agency post-maternity leave, and you’ve got a financial landscape that’s far from rosy.

Secondly, there’s the environmental angle. Recently, I caught myself tossing out an impulse Amazon purchase that just didn’t fit the bill. It was a couple of bucks, so I shrugged it off. But upon scrutinising my Amazon history, I was floored to discover that I’d squandered a whopping $1,900 over the past year and a half on items that served no purpose. As a sleep-deprived new mom, I fell into the trap of impulse buying, only to discard and replace items at will. The guilt is real—both for the waste generated and the money flushed down the drain.

And then there’s the big dream: a grand tour of Australia before my little one, Toby, hits school age. Crunching the numbers on this adventure was a wake-up call. As I dissected our monthly expenditure, it hit me just how much we’re frittering away on frivolities like takeaway coffees. Spoiler alert: it adds up—a lot.

So I posed a simple question to myself: Is that daily cup of joe worth sacrificing a once-in-a-lifetime trip? Absolutely not!

Today, on April 29th, I’m laying the groundwork for success. Planning is paramount; it’s the compass guiding us through choppy financial waters. With a clear roadmap, there’s less chance of veering off course, forgetting crucial dates, and feeling like a failure.

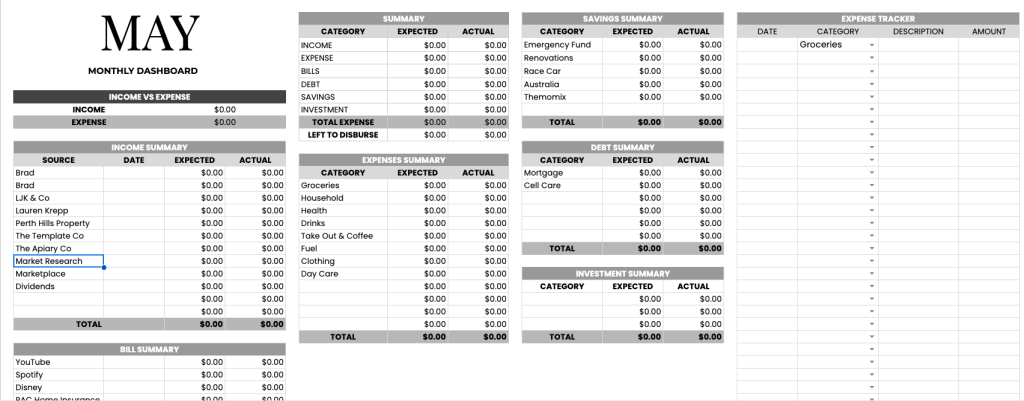

Preparation is key. Armed with my homemade decaf oat milk latte, I’m diving in. I’ve crafted a spreadsheet (coming soon, folks!) to meticulously track income, expenses, bills, debt, savings, and investments. Forecasting our income for the month is no mean feat, given the variable nature of my husband’s and my earnings. But armed with averages and a keen eye for bonuses like overtime or affiliate commissions, I’m up for the challenge.

Next up: the diary. Important dates like Brad’s and dad’s birthday, our anniversary, and Mothers Day are duly noted. Gifts are sorted, plans are made—simple, meaningful celebrations that won’t break the bank.

Now, onto expenses. Armed with recent bank statements and a newfound commitment to tracking, I’m categorising every dime spent. The revelations are eye-opening, to say the least.

To streamline tracking, electronic payments are the name of the game. Receipts are diligently filed away, ensuring accuracy down to the last cent.

But perhaps the pièce de résistance of my plan? Channeling all income and savings into our home loan. With a redraw facility at my fingertips, accessing funds becomes a conscious decision, not a reflex. The extra step of logging onto the bank’s website acts as a reality check—forcing me to pause and ponder: Is this purchase truly necessary?

And so, armed with this strategy, I embark on my journey. Already, I’m brainstorming ways to sprinkle some magic into Toby’s days without relying on pricey play centres or outings.

Stay tuned for next week’s update, and for those following along on TikTok, I’ve got a special series lined up starting Wednesday. Let’s make Money May one for the books!

Comments +